A New Foreign Home Buyers Tax

https://ca.finance.yahoo.com/

This new tax hit may slow down sales in B.C. One will pay 20% transfer tax on the purchase price, speculation tax and now this foreign owners tax. Foreign buyers will use Canadian entities to purchase properties.

Foreign Buyers Tax applies to foreign national, a foreign corporation, or taxable trustee buying a residential property in BC. BC Foreign Buyers Tax rate is 20% of the property's fair market value after February 21, 2018. There are some exemptions as follows

Retail

HBC, has withheld rent at more than 20 locations across the country, according to court documents and landlords.

Some of the biggest landlords – Oxford Properties, Morguard REIT, SmartCentres REIT and Cominar REIT – have taken HBC to court for months of unpaid rent. Some are seeking to evict HBC, while others have not explicitly asked the courts to kick the retailer out.

HBC Forced To Close At Coquitlam Centre

Delinquent in Rent and In Arrears

From Art

I went to Metrotown this afternoon and the mall was packed. Later went to Best Buy and the parking lot was full and a line-up of around 20 people outside. This was the same for some other stores. This may be due to early Black Friday sales which will continue to the end of the month. People may be worried that due to the pandemic there will be further lockdowns of the retail stores so they want to get their shopping in now. Hudson’s Bay occupies huge space in each of the malls as they are anchor tenants. Landlords will need to work out an agreement with HBC as once the pandemic is over people will flock back to the stores. Lots of closed down restaurants having prime locations. Once there is a vaccine people will also flock back to the restaurants….so restaurant operators should be looking to capitalize on this opportunity to take over these prime restaurant spaces and be ready to re-open after the vaccine has been made available to the public.

A Shift

Youngsters from overseas were breeding and living easy life have zero life skills

Now Dad owes Bank of XXXXX a lot for the real estate they developing in China, that is House of Cards but as Ant IPO just proved whose in charge. Evergrande who planned for 4 yrs to back door Shenzhen Real Estate IPO just cancelled it. So certainty of Minting Billionaires is less now.

Evergrande Under Pressure https://www.ft.com/content/c1144ffe-30f9-41d3-b033-bb82eca258b4 https://www.bloomberg.com/news/articles/2020-09-29/evergrande-investors-agree-to-keep-shares-avoiding-repayment https://www.bloomberg.com/news/articles/2020-11-09/billionaire-who-invested-in-evergrande-faces-bondholder-exodus . Hong Kong https://hk.appledaily.com/news/20201110/YO352MY7BJD6RB5QCOM4OI3L7M/ . Last week ended its planned merger with Shenzhen Real Estate https://www1.hkexnews.hk/listedco/listconews/sehk/2020/1108/2020110800003.pdf

Now they have to let their 'tidbit' of overseas investments

e.g. High profile site between 45th and 47th with frontage on Granville

But values won't go down. There is a lot of money around and not very many safe bets, so demand high

Condos

Huffington Post

Yes, everything that could go wrong is going wrong with the condo market. There are also hundreds of condo assignments available. Many contract holders are willing to lose their initial 20% deposit if someone can take over their contracts. To make matters worse some developers having phased projects (such as Aspac's River Green project in Richmond) will NOT allow assignments so the contract holders are obligated to complete their purchases. Investors and first time buyers are putting in low ball offers and sellers that are motivated are accepting the low offers. Buyer preference is for more space with room for a home office and gym space. Developers will need to offer more incentives to attract buyers.

On Pre-Sales

There is a growing number of assignments in Metro Vancouver as well Many investors are just trying to break even or taking a loss. Buyers are coming in at heavily discounted prices hoping to deal with a motivated seller. Once there is a fire sale in a condo project then future buyers will use this low price to negotiate a low price for the other units in the same building. Regarding re-sales, some people are waiting for foreclosures. Vancouver seems to have less actual foreclosures compared to other cities in Canada. Many homeowners somehow at the last minute manage to come up with funds to avoid the court order sale......but as we are in a pandemic more people are hurting and it may not be as easy to redeem the sale.

Molson Site

Concord is very bold in bringing on several major projects (Quantum Park, Bayshore, St. Pauls and others) over the next decade or so. Quantum Park looks like a scaled down Singapore project. The atrium and green rooftop looks nice but the exterior looks pretty dense due to the lower number of stories. The Senakw Squamish First Nation project to the north will block views and provide corridor views between the proposed taller and thinner towers.. Senakw project will offer better views to the north. That's a lot of residential units (10,000 units) and commercial and retail space to be filled up.

Minimum Price: $1 million

So should be no surprise why Real Estate is an 'in-demand' commodity to invest in Canada

VANCOUVER, ASIA | 75 flights a week from YVR to China >> DETAILS

In addition, other carriers to Asia, some of who have two daily flights:

Air Canada, All Nippon Airlines, Cathay Pacific, China Airlines, China Southern Airlines, EVA Air, Philippines Airlines and Sichuan Airlines

Top 20 Commercial Property Assessments

One of the Hottest Markets in the World

Where Immigrants Settle

>> DETAILS

- Shaughnessy-Arbutus is currently 50 percent Chinese and 34 percent white, although the percentage of Chinese in all of Vancouver’s neighborhoods is currently rising >> MORE

- One-third of Vancouver's diplomatic missions now headed by women

- Locals panic > DETAILS

Vancouver is an Asia Pacific city - not just a training ground for Princeling's anymore

Hong Kong's South China Morning Post even reports on our weather now!A Liveable City

|

| Photo by Wendy Williams-Watt |

- Concert in Coal Harbour

- Asia Pacific city

- Vancouver malls richest in Canada

- Best airport in North America

- Flash, Dash , Lots of Ca$h

- Vancouver's Wealthiest Neighbourhoods

- Largest Asian city outside of Asia

- Among most resilient for long-term real estate investment

- Most Livable Cities

- 'Best' marathons

- Economist Report

- E&Y : Canada Amongst Top 5 to Invest Globally

- 43% of Metro Vancouver has Asian roots

- Highest percentage of Condo ownership in Canada - 35% homeowners

- Richest of Vancouver

Advantages:

- Outdoor Activities | Fresh Air - more below if you are interested - just one viewpoint

- Experienced global workforce

- Time Zone - perfect for Europe, NY, Boston, Toronto, and Asia - 24 hours continuous possible

FACTS:

Growth

- City Population Grows by ~ 37,000 per year

- 10 Richest in Vancouver

- Turnover increased by 37% over last year

- Luxury Outlet Mall - YVR 2015

- Pacific Centre - sales of $1,335 psf

- Oakridge - sales of $1,312 psf

- 'Ego Pricing'

TRENDING TOPICS

- Children of foreign born developers, now Vancouverites

- Chinese investors purchaser office towers in Vancouver and Toronto

BUYING FRENZY

Sales volumes for detached luxury homes soared in Vancouver by 38% in first-half 2014. Realtors are saying that more than half of the buyers in prime markets are mainland Chinese.

Vancouver

CHINESE investors' global hunt for prime real estate is helping drive Vancouver home prices to record highs and the city, long among top destinations for wealthy mainland buyers, is feeling the bonanza's unwelcome side-effects.

The latest wave of Chinese money, linked in part to Beijing's anti-graft crackdown, is flowing into luxury hot spots. But it has also started driving up housing costs elsewhere in a city which already ranks as North America's least affordable urban market.

For decades, Vancouver, along with Hong Kong, Sydney and Singapore and, more recently, New York and London has been attracting Chinese and other Asian buyers. >> MORE

- Most expensive resi market in North America

- Conference Board of Canada Report on Apartment Condos >> page 24

Vancouver globally extraordinary, statistically speaking? That’s obvious - wealth migration. Vancouver is the most popular destination city for wealth-based migrants and would-be migrants in the world. Not London, not New York, and not Monaco.

In the past eight years, more than 36,000 rich migrants moved to BC under the now-defunct millionaire migration scheme, which allowed people into Canada after handing over C$800,000 as a no-interest loan to the government. -- 2014 June 4 South China Morning Post

Asians Play Global Monopoly in Vancouver, B.C.

- 'Chinese invasion' of Vancouver Real Estate

- Ho hum...more Chinese ca$h coming to Vancouver

- New Yorker - can't dispute Vancouver is officially part of global citizen's scene - not a satellite of Asia anymore

- Safe haven for global investors'

- Door openers for Chinese

- Millionaires' Visas

- Luxury home sales sizzling

- PRC money likes to 'show off'

- Lineups for False Creek condo...zzz

- City's report on Empty Houses

Double-click articles to View

- 75 weekly flights between YVR and Greater China [including Hong Kong] - the most of any airport in North America

- Vancouver -- Flights from China have increased

- Asian Boost to Vancouver's Luxury Housing Market

Correlation between House Price Increase and Asian Migration

- "Chinese buyers drive Vancouver’s luxury housing market" Sales of houses $3M-plus up 80% over last year

- Vancouver facing an influx of 45,000 more rich Chinese

- Conference Board of Canada says real estate tied to China's economy ;-)

The above graph from "Millionaire Migrants" by David Ley.

No one in Vancouver better understands the impact that rich immigrants have had on the city’s property prices than Professor David Ley.

Ley, holder of the Canadian Research Chair in Geography, literally wrote the book on the subject. Millionaire Migrants, published in 2010, is the definitive account of latter-day East Asian migration to Vancouver, describing how wealthy newcomers and their migratory patterns moulded the city.

It’s no surprise that he has been closely watching the fallout from the Canadian government’s surprise decision last month to terminate the 28-year-old Immigrant Investor Programme (IIP), which has brought tens of thousands of Chinese millionaires to Vancouver.

Oxford-educated Ley has particularly noted attempts to downplay the impact of the scheme and its closure on Vancouver’s sky-high property prices, which he said represented deliberate “suppression”.

“There are interest groups who are in denial and the moment that you or I make a suggestion [about the impact of rich immigrants on property prices] we are immediately racist and this is how the discussion has been closed down,” the University of British Columbia academic said.

“We are very polite in Canada and if anyone raises the red flag of racism then everyone shuts up. To my mind that is an irrelevance. The issue is investors, wherever they are coming from, creating an issue of affordability in the market.”

Ley’s previous research revealed the exceptional correlation between international immigration to Vancouver and the city’s property prices. He charted this from 1977 to 2002, with the results presented in eye-popping clarity on page 153 of Millionaire Migrants. A graph (above) of the two factors shows them moving in near lockstep.

Ley calculated the correlation at +0.94; that’s about as close to a statistical sure thing as you can get.

By contrast, “made in Canada variables” – interest rates, employment, domestic Canadian migration and rental vacancy rates – proved rather hopeless as price predictors. Interest rates, routinely touted as the most significant factor in Vancouver’s property boom, had a negative correlation, of -0.12.

During this period, prices peaked in 1995, then fell when migration from Hong Kong all but ceased. The drops that followed were concentrated in areas favoured by rich Hongkongers, such as wealthy Shaughnessy. “The overall prices dropped, although it was concentrated. In Shaughnessy, prices went down by 25 per cent … that’s a big drop,” Ley said. “But it was not as great across the market as a whole.”

Now for the big question: is the current Vancouver market similarly tied to mainland Chinese migration? And is the cessation of the IIP analagous to the way that Hong Kong migration under the scheme halted in the mid-1990s?

Sadly, Ley isn’t sure. “There are a number of similarities. It’s not perfectly the same,” he said. He notes that the Asian financial crisis coincided with the Hong Kong handover, exacerbating the sell-off in Vancouver as immigrants repatriated their funds to the SAR.

“The combination of the exodus [back to Hong Kong] plus the repatriation of funds led to significant sales and declines in the high-price property markets here,” he said.

Nevertheless, Ley takes issue with some observers who have sought to disregard the impact of the IIP on Vancouver prices. These critics point out that arrivals in British Columbia under the scheme (recently averaging 4,600 individuals, or 1,340 households, per year) are dwarfed by greater Vancouver’s 25,000-30,000 annual residential sales.

“The problem with that argument,” said Ley, “is that if that estimate of a couple of thousand does not include secondary migration from other parts of Canada then that is an underestimate.

“The other point: are people coming in buying only one property? Undoubtedly, it has been that property is the primary form of class mobility and property is a very easy investment to manage. I would question that these folk are only buying one property.”

Ley said the investor migration scheme also fuelled Vancouver’s market in indirect ways – namely, by helping word get out among China’s rich that the city’s real estate market was a convenient, friendly and profitable place to invest. If such word-of-mouth turns in the other direction, will prices do the same? That remains to be seen. -- by Ian Young, SOUTH CHINA MORNING POST 2014 March 5

Asia Audience Mass Awareness

Started With the Expo Site Sale to Li Ka-Shing

The entire 82-hectare site on which the future Creekside Park sits used to be an industrial site. It was bought by the provincial government for $60 million in 1980 and used for the world fair Expo 86.

In 1988 the entire parcel was sold by the Social Credit government of the day for a reported $320 million to Concord Pacific, whose majority shareholder was Hong Kong billionaire Li Ka-shing.

He had outbid BCE Development Corp. and its president, the late Jack Poole.

With the leadership of Stanley Kwok, it took just over 2 years to zone the first area of 12 million sq ft Expo site in Vanoucver. The process involved all levels of government.

This aerial is circa 2010

One sixth of the Downtown Penninsula has been developed by Asia's richest billionaire. Asian investors followed when he came to Vancouver.

And here it is today. We are proud to have been part of its founding history.

- Downtown well serviced by full service grocery stores

- Last New Neighbourhood on the Concord site - 2013

- Trump Vancouver for super wealthy

- West End in the early days

- Concord - property tax efficiency

- 1997 again

|

| Real Estate Fund Manager.com |

Vancouver - Training Ground for Asian Princelings

for several generations i might add. Here's the current cast:

Natural Resources

~ 23% of all condos are vacant

- SOUTH CHINA MORNING POST 2013 June 12

WHERE TO LIVE?

if you are a Citizen of the World

Pink Canopy by Ben Oliver

Pink Canopy by Ben Oliver

Photo courtesy of SCMP

|

So where would your rather be? Fresh air or dismal weather fluctuating between hot and cold? Not to mention the awful pollution.

FRESH AIR

It is the perfect place to practise yoga to get self and soul in alignment.

Golf Clubs in Vancouver

Where else can you go for a walk in the City perimeters and have such solitude and opportunity to take in nature?

Photo courtesy of Leanne Chan

|

Photo courtesy of Leanne Chan

|

It is the perfect place to practise yoga to get self and soul in alignment.

And just a plane ride away to Asia.

This photo from recent walk around The Peak in Hong Kong.

You choose. Where can one think clear on global strategies?

Who Is Buying Vancouver Real Estate?

Chinese Buyers

In Vancouver, where 15 per cent of the population speaks a Chinese dialect as a first language, people from China are the largest group of foreign buyers, according to Sotheby’s survey. They are often buying second homes or investment properties.

Could there be a connection between this statistic and the fact that they like to 'park capital' in safe, freehold, limited land, Asia-friendly Vancouver?

- Suitcases of Ca$h

- Tour bus on the West side

- Mainlanders rattle other Chinese

- Hong Kong connections to Vancouver Real Estate

- 74% Lux buyers are Mainland Chinese

|

| ASSESSED VALUES OF VANCOUVER REAL ESTATE |

- Who Is Buying? - no data base

- Downtown Peninsula - courtesy of Colliers

- CONFERENCE BOARD OF CANADA - Vancouver's Housing Market Connected to China's Growth

- OWNERSHIP, OCCUPANCY & RENTALS | CONDOS IN DOWNTOWN VANCOUVER

Neighbourhoods - Demographic Growth

The map at the top shows the basic population movement in Vancouver’s 22 neighbourhoods over a 10-year period using census data from 2001, 2006, and 2011. A neighbourhood’s population either consecutively rose or fell or it did something in between: rose then fell or fell then rose.

The thing that jumps out of the numbers is how the population increase in downtown Vancouver has nearly kept pace with the entire rest of Vancouver.

| District | 2001 | 2006 | 2011 | Increase |

| Downtown Vancouver | 27,990 | 43,415 | 54,690 | 26,700 |

| The other 21 neighbourhoods | 519,010 | 536,005 | 550,375 | 31,365 |

- VANCOUVER'S REAL ESTATE MIRRORS ECONOMY OF CHINA

- CHINESE BUYERS - Financial Times

- 'THE SWITZERLAND OF ASIA PACIFIC'

- VANCOUVER'S VALUE MOSTLY RESIDES IN ITS REAL ESTATE, so if cosmocrats want to buy condos as retreats or investments, why not let them?

- CHINESE INVESTING IN VANCOUVER SINCE THE '80's

RESIDENTIAL - DOWNTOWN PENNINSULA

Excluding the city’s West End neighbourhood – roughly 52 per cent of condo units are occupied by owners — while 48 per cent are owned by investors who live at another address. --HUFFINGTON POST

Anyone who has walked around Coal Harbour at night already knows that empty, investor-owned condos are the antithesis of community.

If the data released during a panel discussion at Simon Fraser University revealed anything, it’s that empty condos point to a city of speculators and investors. And it doesn’t matter if those investors are from Mainland China, Iran or Ladner.

They’re pushing up property prices by using Vancouver real estate to store their money as if it were one giant “safety deposit box,” to quote one of the panelists.

“The issue is speculation; that was the heart of my presentation,” says Andy Yan, an urban planner and statistics junkie who works for Bing Thom Architects. Mr. Yan gave a presentation that showed a substantial number of condos in downtown Vancouver are empty, and his new report made headlines.

The issue isn’t just foreign investment. It’s the fact that so many developments are investor-owned – and with the revelation that about 25 per cent of them are empty in Coal Harbour, we know a lot of them are not being used as rental stock.

|

| Photo by Ben Oliver |

Life is good for Wei Fuqiang and Chen Qianhong.

Sitting on their 10-metre cruiser in Vancouver's exclusive Coal Harbour marina, the married mechanical engineers recount an unlikely trajectory from wartime China, to Tsinghua University at the height of the Cultural Revolution, to elite careers building particle accelerators in Europe at a time when few of their countrymen were even allowed to leave China.

Little about this remarkable couple is typical - yet as mainlanders they now typify a vast wave of immigration that is rapidly transforming Vancouver.

Wei, 70, and Chen, 68, retired to the west Canadian city from their most recent home, Switzerland, in 2010. Chen said: "They are very different, Europe and Canada. Canada has opened its arms to all people. It's very multicultural. But in Europe, they are always pushing you, they try to integrate you into their culture.

"In Canada, they respect your background, you feel you are thepadrone," she said, lapsing into Italian for "master of the house". "You are not anymore a guest. This is really your home."

The scale and impact of the mainland Chinese influx to Vancouver was laid bare this month in a report for Canada's immigration department, titled "A New Residential Order?"

Author Daniel Hiebert, a social geographer with the University of British Columbia (UBC), projected how mainland migration would fuel the creation of "a social geography entirely new to Canada". Ethnic Chinese numbers in the city of 2.2 million were set to double to 800,000 by 2031, about a quarter of the projected total population, with the city increasingly divided into racial enclaves, and white residents becoming a minority group.

In Richmond, a city of 200,000 in greater Vancouver, mainland Chinese migration has already helped create what is probably the first majority-Chinese city outside Asia.

The mainland Chinese wave has fuelled a property boom that makes Vancouver the second least affordable city in the world - behind only Hong Kong.

There have also been major social shifts, with families divided between a wife and children in Vancouver and a husband working in China. The phenomenon of returnees and part-time residents means thousands of houses and flats are vacant.

Hiebert said there had been relatively little focus on the issue, given the scale of the city's unfolding Chinese transformation. "Are we fully reflective on these changes? No, I don't think we are," he said "But I think Canadians, more maybe than anyone else, have decided to trust the government and immigration policy to decide immigration issues. In Vancouver, we have come to a consensus that a global cosmopolitan society is what we are going to be."

There are both similarities and contrasts to the pre-handover wave of Hong Kong migration to Vancouver in the 1980s and 1990s, Hiebert said.

According to immigration data, mainland Chinese arrivals in Vancouver outstripped those from Hong Kong by 7,872 to 286 in 2012. But even this 27-to-one disparity does not adequately portray the scale of the demographic shift that is taking place, because while the mainlander population is soaring in Vancouver, the number of Hong Kong immigrants actually present in the city has been falling sharply.

|

| Photo courtesy of Hubert Kang |

Mainlander numbers in Vancouver increased 88 per cent to 137,245 between 1996 and 2006, according to the most recent full census data. But Hong Kong immigrants present in the city fell 12 per cent, to 75,780, with nearly all of those losses occurring in the latter five years.

Although 18,890 new Hong Kong immigrants arrived in Vancouver in the decade to 2006, the fall in the number of such immigrants present in the city suggests that 29,325 left Vancouver in the same period. Overall, Hongkongers seem to be leaving Vancouver by the thousands, just as mainlanders are arriving by the tens of thousands.

Canada does not keep records on foreign ownership, but a Landcor Data analysis of all 164 homes sold for more than C$3 million (HK$23 million) in Vancouver's core Westside neighbourhood in 2010 showed that 74 per cent were sold to buyers whose names were mainland Chinese spelling variants and who did not have any Western legal name.

"Lots of buyers, the wife and children will stay in Vancouver, but the husband will still live and work in China."

That common scenario reflects the difference between Hong Kong and mainland government attitudes towards Canadian citizenship.

David Ley, author of the book Millionaire Migrants about modern East Asian migration patterns, said China's prohibition on dual citizenship made it less attractive for a mainland Chinese migrant than for a Hongkonger to go "all the way" and seek Canadian citizenship, a process he termed "passport insurance".

"For a mainland Chinese, if they want to go back to China with a Canadian passport, they are at a disadvantage, unlike people from Hong Kong who are able to hold both [Canadian citizenship and Hong Kong permanent residency]," Ley said. "The stakes are much higher. If they ... get a Canadian passport then they are taking a much bigger risk."

Ley, also of UBC, added: "Around 2000 there was an almost complete transition in migration, switching to the PRC instead of Hong Kong and Taiwan. In other words, everyone [from Hong Kong or Taiwan] who wanted a passport got one."

Another key difference between the Hong Kong and mainland Chinese waves is their potential scale and duration. "We know for sure there is very deep wealth in the mainland, whose holders want to diversify. [A recent study suggests] that 20 per cent of those very rich wanted to come to Canada," Ley said. "We are talking about a substantial body of wealth that won't run out in the way that Hong Kong [migration] did. Over the years we are looking at an ongoing presence, depending on a variety of factors."

Mainlanders outnumbered Hongkongers in Vancouver some time between the 1996 and 2001 censuses. In that period there were 85,756 mainland arrivals to the city. But that only reflected the speed with which Canada's immigration authorities could process their applications. There is a vast backlog.

When asked whether she saw any downside to the mainland Chinese influx, real estate agent Lau agreed that local first-home buyers were struggling. But she added: "I see a lot of people here who bought in West Vancouver a long time ago. They can sell for a lot of money and move somewhere else. It's very good for them."

Hiebert said that when the Globe and Mail newspaper used the alarmist term "white flight" to describe what was happening in Vancouver's suburbs "they got hammered for it". "I'd use a different term to white flight," Hiebert said with a laugh. "I'd call it 'cashing in'."

There have been some tensions, in addition to grumbling about property prices. In Richmond, where the proliferation of Chinese-only business signage has upset some long-time residents, the city council was presented with a 1,000-name petition demanding an English component to all signage. "It [Chinese-only signage] has got progressively more noticeable," said Richmond resident Kerry Starchuk, who helped organise the petition. Richmond's council rejected the petition's demands.

After almost 30 years in Europe, Wei, one of nine children, said he once hoped to retire in China. "I wanted to come back. In China we have many friends, many relatives, and the food is good too. With our money, China would be very comfortable."

Chen shook her head: "He is crazy! Not many would agree with him." Chen wants to apply for Canadian citizenship - "Chinese should involve themselves more in the community," she said - although her husband, reluctant to give up Chinese citizenship, does not.

They agree, however, that their new city was the right choice. With their son, daughter-in-law and three-year-old granddaughter living nearby, Vancouver is their home. "Now, this is perfect," said Wei, waving an arm over the marina. "I never want to have regrets."

Children of rich Chinese home alone in Canada face challenges

When Danny Kuo was 18 years old, he was living alone in a large home in the exclusive Vancouver neighbourhood of Dunbar. He was a pre-medical student at the University of British Columbia.

|

| VANCOUVER SUN 2012 Feb 27 |

80% Sales to PRC

|

| SOUTH CHINA MORNING POST |

- Mainlanders divisive for Other Chinese

- Service +++ Trump Tower

- Burrard Gateway - 1 million sq ft approved

Disaffection with Leung Chun-ying sees renewed flight to Vancouver, says activist

Vancouver could be facing a new wave of immigration from Hong Kong amid growing discontent since Chief Executive Leung Chun-ying took office, according to a democracy activist based in the Canadian city.

Henry Chau, chairman of the Vancouver Society in Support of Democratic Movement, said Hongkongers increasingly felt they were being pushed out of their own city by mainlanders and that they were looking for alternatives.

However, Labour Party lawmaker Cyd Ho Sau-lan believes that although the pan-democratic camp has issues with the chief executive and his government, Chau has no hard facts to back up his claims.

Tens of thousands of Hongkongers moved to Vancouver before the handover in 1997, but in recent years the tide has reversed.

Chau said: "I have many friends from Hong Kong, and all have a grim view for the future of Hong Kong. It is not the Hong Kong of 10 years ago. They now feel like there is no room for them any more."

Chau said anecdotal evidence suggested that many returnees - Hongkongers who migrated to Canada but then returned to Hong Kong after the handover - were now going back to Vancouver, dissatisfied by changes in the city of their birth. He said that such movements would be difficult to chart, because the returnees were Canadian dual citizens who did not show up on records as new immigrants.

"But when, for instance, we talk to our family doctor, we hear about people who have been away [in Hong Kong] for many years who are now coming back [to Vancouver]," Chau said.

"C. Y. coming to office has accelerated the discontent and the frustration," he said. "But people understand that C.Y. himself is not the underlying problem. People are frustrated because they have no control over their fate."

However, Ho said: "It's hard to justify what he is claiming without concrete facts and figures. It's not hard to substantiate a claim if you have this information, but Mr Chau does not seem to have this."

Ho said it was only when substantial facts and figures were provided by Canada's Immigration Department that Chau's claims could be taken seriously.

"He is just giving an opinion - nothing else," Ho said. "Until he can back this up with hard facts, it means nothing. I would be suspicious of what he has to say until he can." 2013 August SOUTH CHINA MORNING POST

- Limited Brands Inc. (NYSE:LTD) signed a lease for 35,000 square feet at the corner of Robson and Burrard streets and plans to put the second largest Victoria's Secret store in North America in the marquee location that formerly housed HMV. >> Business in Vancouver

- Nordstrom's launching in Canada

- Nordstrom coming to Downtown Vancouver - Jim Cheng designing

- Swarovski and Ecco Shoes moving next to L'Occitaine on Robson

- Thermal sensors track 17,000 pedestrians a day on Robson

ALBERNI Retail

- COAL HARBOUR COMMERCIAL DEAD

- OFFICE MARKET -DEVELOPMENT

- 4% VACANCY IN DOWNTOWN OFFICE| but not a head office city

- The Village at Thunderbird Centre was acquired by Sun Life for a reported $148 million; and

- the plaza at New Westminster Station was acquired by First Capital Realty for $100 million plus an earn-out of up to $20 million.

- Ivanhoe Cambridge and the Tsawwassen First Nation’s planned Tsawwassen Mills project;

- Property Development Group’s planned Tsawwassen Commons project;

- Vancouver International Airport Authority and McArthurGlen Group’s planned outlet mall on Sea Island;

- Shape Abbotsford West LP and Hoopp Realty Inc.’s under construction Highstreet in Abbotsford.

- Morguard Investments Ltd. and Pension Fund Realty Ltd.’s Coquitlam Centre;

- Ivanhoe Cambridge’s Guildford Town Centre;

- Shape Properties (Brentwood) Corp. and Brentwood Towncentre Inc.’s Brentwood Town Centre;

- Park Royal Shopping Centre Holdings Ltd.’s Park Royal Village and

- Ivanhoe Cambridge’s Oakridge Town Centre; and

- Aberdeen Project Thirteen Ltd.’s Aberdeen Square.

Only two retail assets have sold with a price tage of $50 million or more in 2012:

Having few opportunities to buy malls means there are two options for developers: build new malls or expand existing properties.

New malls in various stages of planning and development include:

Some of the many mall expansions, which are either underway or slated, include:

- PARK ROYAL on the NORTH SHORE with 1 million sq ft of commercial is hopping

- SEARS DEVELOPMENT IN BURNABY

- LARGEST SHOPPING CENTRES IN GREATER VANCOUVER

- Guildford Town Centre's $280-million renovation ... - Vancouver Sun

- NORDSTROM's COMING TO VANCOUVER

- FEW OPPORTUNITIES TO BUY SHOPPING CENTRES - They are owned by Instititutions - Concentration of Ownership

Richmond Outlet mall at the airport

Denman

LAND COSTS - PRICE PER BUILDABLE

|

| BC Business Magazine - September 2013 |

DEVELOPMENT COST CHARGES

- http://www.theglobeandmail.

com/report-on-business/canada- post-delivers-mailbox-fee-to- developers/article4952346/ - Developers deserve credit for contributions to creating communities

TAX

GST: The new GST/PST tax regime took effect on April 1st, 2013.

NEW CONSTRUCTION:

For more details, see the government's GST/HST info sheet.

PROPERTY PURCHASE TAX | ' Stamp Duty'

The Province of B.C.'s Property Transfer Tax, which will remain the same: 1% on the first $200,000; 2% on the balance.

|

| National Geographic 1992 - Vancouver's long history with Asia |

MISC.

- Parking stall for sale in Vancouver

- Vancouver's Richest

- Flawed data

- Vancouver's current mayor

- Mezzanine Lenders

- Largest Property Managers (2013)

- Ha ha...asian-style living in Vancouver - they call it 'closets'

- Largest Real Estate Deals of 2013

- Global real estate prices driving local market

- Hotel Van & Royal York for sale

- Canada Post site on Georgia

- Robson & Granville : Sony Imageworks and Nordstroms

- Here's what's happening at Oakridge. We're friends with the developer.

- Largest property transactions

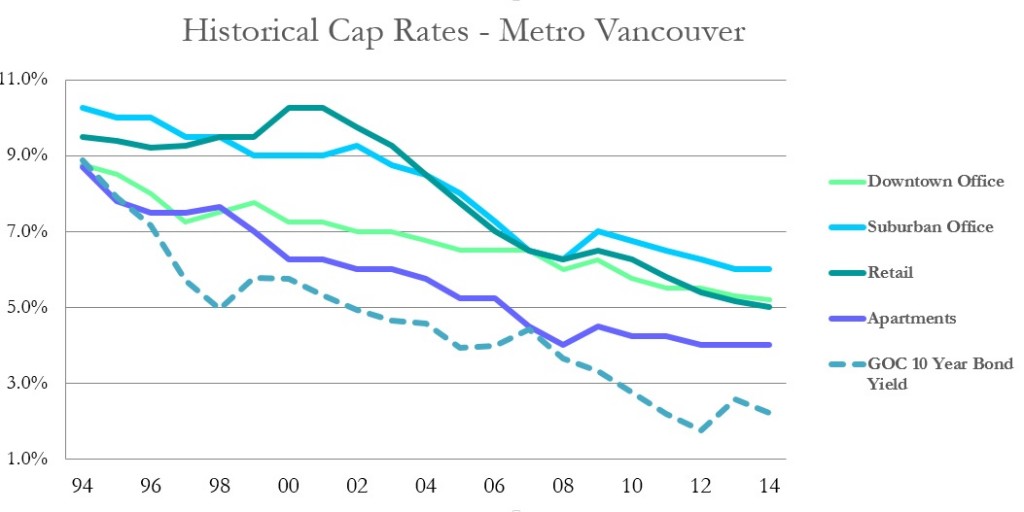

Market Spotlight: Metro Vancouver Cap Rates in Q3 2014

Here is an update to a graph that has been posted here many times previously. Cap rates are continuing a downward or flat trend across most asset classes amid a continued influx of capital and a continued environment of relatively cheap debt and low interest rates.

Suburban office buildings appear to be the one exception in mid-2014, likely reflecting worsening leasing fundamentals and increasing vacancy in many areas such as Burnaby. While there doesn’t appear to be much room for continued compression in the other asset classes, Vancouver tends to be a market that defies logic.

SCMP : calling it as it is

Vancouver's issue with foreign money

City sets cap on rents for new rental development

Vancouver's issue with foreign money

City sets cap on rents for new rental development