Singapore Investors | Outbound

Average billionaire in Singapore is 64 yr old Male

This is one of the many insights thrown up by the inaugural Wealth-X and UBS Billionaire Census 2013, released yesterday.

The report affirms Asia as a wealth hotspot: Asia saw the highest percentage rise in billionaire population (3.7 per cent from 2012 to 508 individuals). It also experienced the strongest surge in wealth - 13 per cent to US$1.18 trillion.

These figures suggest that Asia "is driving the tectonic shifts in wealth globally", said a joint statement by UBS and Wealth-X. The latter researches the ultra-high net worth segment, defined as those with assets of at least US$30 million.

Asia contributed the largest number of new billionaires this year at 18, followed by 11 in North America. Globally, there are some 2,170 billionaires, compared with 2,160 in 2012.

Their combined wealth grew 5.3 per cent to US$6.5 trillion from US$6.19 trillion last year. Interestingly, their combined wealth this year is enough to fund the US budget deficit until 2024, and is greater than the GDP of every country except the US and China.

By 2020, UBS and Wealth-X expect the billionaire population to exceed 3,800. This is a projection based on existing "demi-billionaires" - that is, those with a current net worth of between US$500 million and US$999 million.

Said the report: "When taking into account those not yet worth US$500 million, the increase in the billionaire population is likely to be even higher.

"For example, many 'technopreneurs' continue to increase their wealth rapidly, and are able to achieve billionaire status in the span of only a few years."

China has the second-largest billionaire population globally, after the US. It has 157 billionaires with a combined net worth of US$384 billion; the US has 515 billionaires with a net worth of just over US$2 trillion.

Singapore has the fifth-largest billionaire population in Asia, and the 18th largest in the world. In terms of the world's cities, it ranks sixth. New York is the top choice among billionaires, with 96 choosing to base their primary businesses there.

According to the data, the average billionaire globally is worth US$3 billion. About 35 per cent or US$1.27 billion of this wealth is in private holdings. Another 35 per cent or US$1 billion is in public common stock. Cash accounts for 18 per cent or US$545 billion, and real estate 3 per cent or US$78 billion.

The report said that the liquidity cushion is higher than it was before the global financial crisis in 2008, "suggesting that the old mantra of 'cash is king' remains as relevant as ever".

Globally, about 60 per cent of billionaires are self-made, while 20 per cent inherited their wealth. In Singapore, 44 per cent are self-made and 15 per cent inherited their wealth. Some 41 per cent inherited wealth and subsequently grew their fortunes.

In a foreword in the report, Josef Stadler, UBS global head of ultra-high net worth (UHNW), said that the top UHNW segment continues to grow even as the path to economic recovery remains challenging.

"This makes the billionaire segment interesting to any bank with a strategic UHNW foothold. Yet, billionaire clients have particularly complex demands, and the challenge lies in providing them with the right offering to help them achieve their financial goals."

"This makes the billionaire segment interesting to any bank with a strategic UHNW foothold. Yet, billionaire clients have particularly complex demands, and the challenge lies in providing them with the right offering to help them achieve their financial goals."

- Singapore boasts densist Millionaire population in the World

- Tops for world's global rich

- Kwee family in New York

- Keppel teams with Vanke

Singapore's Richest Billionaires

<< Double click List to view

According to data obtained from Hurun's Global Rich list, brothers Robert and Philip NG of the Far East Group top the list.

They are followed by Wee Cho Yaw, the current Chairman of the United Overseas Bank (UOB); Sukanto Tanoto, an Indonesian magnate who relocated to Singapore in the 1990s and Richard Chandler, a New Zealand born entrepreneur who is based in Singapore.

Altogether, the 11 Singapore-based billionaires have total wealth of $28.7 billion.

- Singapore Business Review

Property magnates Robert and Philip Ng added S$1.79 billion to their wealth to hold on to the No. 1 spot as the country’s richest. Their net wealth is S$13.5 billion, up from $11.8 billion last year. The brothers oversee Far East Organization which their late father Ng Teng Fong developed into a conglomerate with more than 700 hotels, malls and condominiums in Singapore and Hong Kong.

The biggest rise in net wealth this year is that of Kwek Leng Beng, Chairman of City Developments, Singapore’s second largest property developer, who jumped to the second spot from No. 6 with a net worth of $9 billion, up from $3 billion.

The big boost was due to the inclusion of a broader group of assets and some more shares of family. His fortune includes the interests of siblings and cousins Kwek Leng Peck and Kwek Leng Kee.

Despite these highs, there are signs that things are cooling in the Singapore property market, as recent rounds of curbs by the government to prevent a property bubble have dampened sentiment though not as yet real estate prices. Not resting on his riches, Kwek Leng Beng is stepping up investments in China and London.

The Khoo family is now at No. 3 with a net worth of $8.55 billion, the same as last year. The heirs of late banker Khoo Teck Puat sold the biggest chunk of their inheritance, a stake in Standard Chartered Bank, in 2006 for $5.11 billion, but retained ownership of the Goodwood Group of Hotels.

Other outward-looking property tycoons include the Kwee brothers, who are richer by $1.53 billion this year. They are negotiating to invest $383 million in a Manhattan luxury condo. Veteran investor, Peter Lim, who ranks No. 10 on the list this year with a wealth of $2.56 billion, is also looking to invest in Malaysia’s Iskandar region.

In addition, Ron Sim of OSIM International enters the billionaires ranks for the first time as shares of his massage chair company doubled in the past year. New information on his private assets also added to his wealth such as his stakes in historic buildings in Singapore and property in China.

Singapore’s status as a safe haven for Asian capital remains solid, drawing the likes of Serge Pun (No. 38, $638 million), a Singapore’s permanent resident whose listed Yoma Strategic Holdings is enjoying a good run on the back of Myanmar’s economic prospects. He is one of ten newcomers to the list this year.

Others who debuted on the list include: Nippon Paint’s partner, Goh Cheng Liang (No. 9, $2.7 billion), Ching Chiat Kwong of Oxley Holdings (No. 36, $651 million), coffee king David Teo of Super Group (No. 37, $645 million), Loi Kai Meng who chairs CWT (No. 39, $600 million), jeweller Koh Wee Seng (No. 40, $575 million), Stanley Liao who cofounded C&P Holdings (No. 41, $562 million), Cheo Tong Choon, a medical doctor who controls edible oils refiner, Mewah International (No. 43, $549 million), Teo Kok Leong who owns Roxy-Pacific Holdings (No. 47, $460 million) and Chew Thiam King of marine services firm, Ezion Holdings (No. 50, $389 million).

The minimum net worth to make the list this year was $305 million.

- 2013 August 29 ASIA ONEChina Investment in Singapore

In Singapore, a US$1 billion (S$1.24 billion) mixed-use hotel and retail scheme was sold to Bright Ruby which is controlled by China's Du family, making it the single biggest commercial property transaction in the city-state. - 2013 November 15 Yahoo Singapore Finance

Singapore Office market

Singapore Residential

Photo courtesy of Fiona Bartholomeusz

Capitaland Raises S$750 million

CapitaLand, a Singapore-listed real estate developer, took advantage of the positive market response to the US Federal Reserve’s decision last week to keep its bond-buying programme unchanged, selling S$750 million ($596 million) worth of convertible bonds.

The deal, which launched and priced on Thursday last week, came just four months after the company raised S$650 million from another CB issue. Investors did not seem to mind that the company was returning to the market this soon, however. This was partly because there has not been much new CB issuance this year and investors are happy to see new supply, artly because, like CapitaLand’s previous transaction, the deal was accompanied by a tender offer for some of its outstanding CBs.

According to a source, the intention is to match the size of the new issue and the amount of bonds it will buy back through the tender, rather than to increase the amount of outstanding bonds and raise new capital. The tender offer includes two bonds maturing in 2016 and one bond maturing in 2018. It opened on Friday last week and will close on October 10.

As one of the top-quality CB issuers in Asia – it is the largest real estate developer in Singapore and has a strong credit profile – CapitaLand is also one of those names that all serious CB investors have to own. And the possibility of switching into a new issue with a higher option value did attract some of its current CB holders. The source estimated that about 30%-35% of the buyers of last week’s transaction would likely also tender some of their existing bonds, suggesting that the accompanying tender did help add to the demand.

In all, the base deal was said to be about two times covered and the book was said to include some pretty big orders, even though the terms were quite aggressive. For one, CapitaLand once again chose a maturity that was significantly longer than the market average – this time a 10-year with a five-year put option.

The CB it issued in May had a seven-year maturity with no put, and in the past the company has sold convertible bonds with even longer maturities. In 2006 it issued a 10-year CB with a seven-year put and in 2007 it entered the record books with a 15-year deal that came with a first put option at the end of year 10 and a second one at the end of year 12, giving it an effective 10-year maturity.

Taking full advantage of the demand, CapitaLand chose to upsize the deal by a greater-than-indicated S$150 million for a total deal size of S$750 million. It was initially launched with a base size of S$600 million and an upsize option of S$100 million.

Meanwhile, it was able to fix the conversion premium above the bottom of the indicated range of 28% to 33%. The final premium was set at 30% over the latest market price of S$3.24 for an initial conversion price of S$4.212, a level that the stock has not traded at since January 2010.

The coupon and yield were, however, fixed at best terms for investors – at 1.95%. They were marketed in a range of 1.45%-1.95%.

At a marketed credit spread of 150bp, an assumed stock borrow cost of 50bp, dividend protection for payouts exceeding a fixed amount each year, and an estimated stock slide of 3%, the terms resulted in an implied volatility of 18.9%.

The source said this was in line with the historic volatility, with the 30-day, 100-day and 260-day volatility gauges all between 19% and 21%.

That is quite aggressive, particularly at this large size. Indeed, the CB was quoted slightly below par in the grey market during the bookbuilding. However, it opened at 100.25 to 100.625 on Friday and traded up to about 101 during the session, sources said. The share price fell by a less-than-expected 2.5% to S$3.16, although volumes were fairly thin because markets in Hong Kong, China and South Korea were all closed to celebrate the mid-autumn festival.

CapitaLand’s share price has had a difficult time this year and as of last Friday it was down 21.6% from its 2013 high of S$4.03, which it hit in late January. Also, it was trading only 7.8% above its late August low of S$2.93.

Bankers said the holiday on Friday was one reason why there were not more equity deals in the market on Thursday, despite pretty big gains across Asian equity markets after the Fed surprised forecasters by deciding not to start tapering just yet. Hong Kong gained 1.7% and Singapore was up 1.9%, while India’s Bombay Sensex index added 3.3% and Indonesia jumped 4.7%.

However, doing a deal – a block trade in particular – the day before a holiday is always difficult as it increases the market risk for investors that buy into the transaction. Because of that they either stay away altogether or ask for a bigger discount to compensate for the higher risk.

CapitaLand did not have to deal with that as Singapore was open as normal on Friday. To make sure it did not miss any Hong Kong-based investors before they headed home for the long-weekend, the company suspended the stock at 12:50pm on Thursday and launched the deal about 30 minutes after that. The order book was kept open until about 8pm that same evening.

The source said the demand was pretty evenly split between Asia and Europe, with some participation from the US as well. Outright investors accounted for about 70%, while the rest of the demand came from hedge funds. This was perhaps a bit surprising since there is plenty of stock borrow available, making it easy and relatively cheap for hedge funds to hedge the equity option.

That said, CapitaLand does have a strong following among some key long-only investors. The bond floor was also not too demanding at 95.1%.

In all, the deal attracted close to 50 investors, which was slightly fewer than in May when more than 60 accounts came into the transaction.

The tender offer

Part of the reason why CapitaLand is so keen to buy back its outstanding CBs is that it has several deals maturing or becoming puttable in a relatively concentrated period between 2015 and 2018. The latest two deals, in May and last week, have been designed to extend its maturity curve, while at the same time raising capital to allow it to stagger the payments needed to cover the maturing bonds, thus easing the pressure on its balance sheet.

The company invited investors to tender the following CBs:

- The 2.1% CB due 2016, which was issued in November 2006 at a size of S$430 million and will have S$184.75 million left outstanding after taking into account the amount of bonds that will be redeemed in November as a result of a put option. The minimum tender price will be 97% of the principal amount and the maximum price will be announced by the company on September 30.

- The 2.875% CB that is also due in 2016. It was issued in September 2009 at a size of S$1.2 billion and has S$971 million left outstanding. Investors can tender the bonds at a price between 102% and 106%.

- The 3.125% CB due in 2018, which was issued in March 2008 and becomes puttable in 2015. It had an initial size of S$1.3 billion and S$557.5 million left outstanding. Investors can tender the bonds at a price between 108% and 111.5%.

The tender will be done through a modified Dutch auction, with CapitaLand determining a single purchase price for each bond. The final amount of bonds that it will buy back will depend on the amount tendered and the price, but the total will not exceed the S$750 million raised from the new bond, the company said.

The tender price ranges are not overly generous as they basically straddle the market prices of the three CBs. In other words, CapitaLand is not providing much incentive for existing CB holders to tender. In a way that is odd as it obviously would not launch two tender exercises this close to one another if it did not want investors to take it up on its offer. However, the company clearly does not want to – or feel that it has to – pay over the top to buy back the bonds.

In its previous tender, which was completed in mid-June, it bought back S$432.5 million worth of the same 2018 CB that is part of this latest offer. The company received valid tenders totalling almost S$620 million and fixed the repurchase price at 111.5% versus an earlier announced maximum price of 112%. That was about 1 point above the market price at the time, translating into a modest 20bp premium per year based on the five years that remained until maturity.

Credit Suisse was the sole bookrunner for the CB and is also acting as the sole dealer manager for the tender offer. The Swiss bank also arranged the previous tender and was a joint bookrunner for the May CB together with Bank of America Merrill Lynch. - 2013 September 23

FINANCE ASIASky Vue sells 80% of the project on launch day

Sky Vue, a 694-unit 99-year leasehold residential project near Bishan MRT, reportedly sold 410 of the 505 units released on its first day, at an average price of $1,500 per square foot – this translates to a sell-through ratio of around 80% of the units launched and 60% of the entire project. Most of the units sold were small one- and two-bedroom units, with the average price of a one-bedroom units around $750,000 while that of a two-bedroom units being $933,000.

The developers, CapitaLand and Mitsubishi Estate Asia, managed to keep the total cost of the units under the magical $1 million (and thus appeal to mass market investors and upgraders) by shrinking the size of the units. One-bedroom units ranged in size from 484 to 592 square feet, versus next door Sky Habitat’s 635 to 958 square feet for one-bedroom units. Sky Vue’s two-bedroom units ranged from 678 to 915 square feet in size versus the 721 to 1485 square feet of Sky Habitat’s.

Sky Vue sells individuality to young Singaporean home buyers

A campaign launched in Singapore today to promote new property development Sky Vue.

Jointly developed by CapitaLand and Mitsubishi Estate Asia in Bishan on Singapore’s city fringe, the campaign is targeting singletons, young

couples and families.

couples and families.

The idea behind the campaign is to show that buyers can retain their own sense of individuality while living at Sky Vue.

Fiona Bartholomeusz, MD of Fomul8, the agency behind the campaign, said: “When people are faced with many choices for what is a very big decision in life (buying a home), what ultimately stands out is an emotional attachment to how that home would make them feel. Location, luxury, amenities have become almost expected by Singapore standards. What is missing is an emotional sell so that people see themselves making a home there and being happy, and that ultimately is what we all seek in the places we choose to live in.”

The campaign runs through the line – from name/logo development, advertorials, above the line ads, website, online banners, e-brochures and social media across Facebook, YouTube, and Pinterest.

Bartholomeusz added: “With the recent government cooling measures announced, buyers are now facing a tougher time in obtaining bank loans and financing for property purchases. This no doubt adds to the challenge of marketing a new development to an audience that sees no less than 20-30 property ads in the papers on any given weekend.”

“Sky Vue had to differentiate itself beyond location and its unique selling points, and we wanted to cut through the clutter of saying the same things and putting out the same visual directions as with all other ads,” she said.

Well done Fiona!! Congratulations.

Asia's ultra-rich like Singapore as Principal Residence

Besides stable, political, economic conditions, there's favourable taxation

The availability of top quality education has made Singapore the second top location for the ultra-rich in Asia to buy second homes. This is particularly true among the Chinese and Indians, according to Citi Private Bank-Knight Frank Wealth Report.

And when it comes to principal residence, Singapore is the first choice for Asia's ultra-high net worth individuals (UHNWIs), especially Indians. In addition to the stable political and economic conditions, Singapore offers favourable taxation policies to these wealthy individuals, said the report.

The pricing of luxury properties here is also much lower than in other markets such as Hong Kong, Tokyo, Paris, London and Monaco.

The report was based on an online survey at the beginning of 2011 by 160 Citi Private Bank wealth advisers representing almost 5,000 UHNWIs from 36 countries. The average worth exceeded US$100 million.

According to the Attitudes survey, education is one of the primary reasons for second-home purchases, especially among East Asian UHNWIs.

Said Rupert Hoogewerf, publisher of the Hurun Report which lists China's rich: 'A property for (university-going) children to live in is an obvious step to take and a very popular investment option. Anecdotal evidence indicates that the condition of property markets can be an influencing factor when universities are being assessed.'

Besides the UK and the US, other top choice locations for education are Canada, Australia, New Zealand, Hong Kong and Singapore.

Meanwhile, Singapore has retained its position as the fourth top global city for the super rich. It, however, risks falling to the sixth spot as Shanghai and Beijing are seen rising up the ranking in the next 10 years.

The report also showed that property remains very much a part of the rich's portfolio. Other than their own businesses, brick and mortar remain the second most trusted place for the world's ultra-rich to store their wealth. About 35 per cent of the portfolio of the world's UHNWIs are allocated to property.

And property is not about to lose its appeal any time soon, despite the severe correction in the West following the global financial crisis and the record prices in the East. Enthusiasm for this asset class has increased in the last five years.

In fact, of all the asset classes out there, the world's ultra-rich are most enthusiastic about property, more so than equities, government bonds, corporate bonds, commodities and gold.

Revealing the cultural bias of East Asians for property, the UHNWIs in this part of the world are as enthusiastic about property as they are about their own business. The rich from other regions rank their own business higher.

Of the various property sectors, direct ownership of residential property is the most favoured, with 28 per cent of those surveyed considering buying another second home outside their country of residence.

Broken down into the various regions, more of the rich from Africa, Russia and Commonwealth of Independent States, Middle East, Europe and East Asia are considering buying a second home outside their home countries.

Overall, the survey showed the continued shift of wealth to the East.

Stephen Wall, director of consultancy Scorpio Partnership, said that his firm's Wealth Distribution Model confirms that one big story is the money now sitting in the Asia-Pacific - US$11 trillion.

'While still third behind North America (US$13 trillion) and Europe (US$11 trillion), it is fast catching up. Bar a huge economic crisis, it will snatch second spot from Europe by the end of the year. North America - and the world lead - is in its sights,' he said.

Broken down into the various regions, more of the rich from Africa, Russia and Commonwealth of Independent States, Middle East, Europe and East Asia are considering buying a second home outside their home countries.

Overall, the survey showed the continued shift of wealth to the East.

Stephen Wall, director of consultancy Scorpio Partnership, said that his firm's Wealth Distribution Model confirms that one big story is the money now sitting in the Asia-Pacific - US$11 trillion.

'While still third behind North America (US$13 trillion) and Europe (US$11 trillion), it is fast catching up. Bar a huge economic crisis, it will snatch second spot from Europe by the end of the year. North America - and the world lead - is in its sights,' he said.

RESIDENTIAL MARKET

PUBLISHED SEPTEMBER 06, 2013

Developers trim prices as new reality bites

New launches priced below expectations as buyers struggle to secure loans

[SINGAPORE] The impact is now there for all to see. Developers have been trimming launch prices for new private residential projects to adjust to the new market reality in the aftermath of the Total Debt Servicing Ratio (TDSR) framework's rollout in late June.

A case in point is the 445-unit Thomson Three condo in Bright Hill Drive, being developed by UOL Group and Singapore Land.

"Without TDSR, we could easily have priced this project at $1,500 psf on average, or even higher. We now expect to price it at a more realistic level, at $1,350-1,400 psf," said Liam Wee Sin, president (property) at UOL.

The showflat of the project, located at the Upper Thomson Road/Venus Drive corner, will open this weekend, although sales booking will begin two weeks later, on Sept 20.

Avalanche of supply till 2016

According to data provided by Orange Tee, a total of 33,555 units are expected to make it to the market in 2016, compared with the 15,503 units that are available this year.

Of this, 27,181 units will originate from newly launched projects while the remaining 6,374 units will be from the stash of previously locked-up units, assuming that owners choose to hold onto their properties and not incur any SSD [Seller Stamp Duty].

This follows enhancements to the SSD scheme in 2011, which saw the holding period raised from three to four years, and rates increased steeply up to 16 per cent.

>> SINGAPORE BUSINESS TIMESDISTRICT 10

One Balmoral: Prices start at $1.5 million at the 91-unit project in District 10. - PHOTO: ONE BALMORAL

[SINGAPORE] Hong Leong Holdings yesterday announced that it would be launching a freehold condominium this weekend. One Balmoral, as it has been named, is along Balmoral Road, just off Stevens Road and in the high-end residential area of District 10.

The 91-unit project will consist of 11 one-bedroom units, 35 two-bedroom units, 32 three-bedroom units and 13 four-bedroom units. The size of the units ranges from 592 square feet for the one-bedders to 1,657 sq ft for the four-bedders. Prices start at $1.5 million.

Describing its appeal, Betsy Chng, Hong Leong's head of sales and marketing, said that One Balmoral was designed with luxury in mind, with each unit fitted with designer wardrobes and Italian-made kitchen cabinets. The development has facilities such as a lap pool, a clubhouse and a meditation garden, and is near Orchard Road, Raffles Town Club and The Pines Club.

Its launch comes after those for other Hong Leong developments catering to the luxury segment, such as Sage at Nassim Road and The Meyerise along Meyer Road. The show suites for One Balmoral are along Cuscaden Road and will be open from 10 am to 6 pm daily.

|

PUBLISHED JANUARY 14, 2013

COMMENTARY

Why Singapore's property market has defied gravity

For Singaporeans, besides the stock market (which is now richly valued and needs specialised knowledge), property looks better than leaving money in the bank - which earns almost nothing and in fact, is a sure loser after taking inflation into account

OFFICE MARKET

|

|

|

|

On Sunday, it was announced that Alpha Investment Partners' Macro Trends Fund and NTUC Income have agreed to buy Capital Square at Church Street for $889 million or about $2,300 psf on net lettable area - marking the biggest Singapore office transaction so far this year. Cushman & Wakefield brokered that transaction. The seller is Ergo Insurance Group - a subsidiary of reinsurer Munich Re.

|

| Credit Suisse Research |

Published March 8, 2011 | |

Cooling measures for office market? |

Having said that, we did not expect the sheer strength of rebound that followed. While the office market declined further in H2 2009, the turning point was almost at hand. The negative impact of the recent crisis on the office sector can now be characterised as sharp and short. Indeed, the market held up far more robustly than it did in past cycles.

Extraordinary year And then there was 2010. It was an extraordinary year in so many ways. In response to stellar GDP growth at 14.5 per cent, take-up was pretty strong coming in at 1.65 million sq ft (202 per cent above the 10-year average). Impressive indeed, but not the whole story by any means. The stand-out feature of last year was the sheer volume of leasing activity, much of which was focused on the large new developments completing in 2010-2012. Our firm advised seven anchor tenants in office leasing deals (more than 100,000 sq ft each) that completed in 2010 out of the record total of nine such deals. In a typical year one might expect, say, two such deals to be concluded in Singapore. It was a highly fruitful year for developers, with new office space being pre-let at an increasing pace during the year. At the start of 2010, of the 4.6 million sq ft of prime CBD space due to complete within a two-year horizon, a relatively modest 40 per cent was pre-let. By the close of the year 71 per cent of such space had names against it, translating to an additional 1.4 million sq ft of new deals done in 2010. In response, average monthly Grade A and prime rents rose at a brisk pace gaining 22 per cent and 23 per cent year on year to close at $9.90 per square foot and $8.30 psf respectively. The effective rents achieved for pre-commitment lease deals were up about 40 per cent from the low point in late 2009. With all this exuberance, and taking a cue from the residential market experience, one wonders whether there might be a need for cooling measures in the office market. Govt reactions In the past, government policy reactions have ranged from increasing the number of government land sales (GLS), introducing transition sites (on 15-year tenures) and putting a temporary stop to conversion of offices to alternative uses. It has also directed government bodies to vacate CBD space. The key issues in determining whether such measures are warranted appear to be: (1) Is there enough good quality office space for business and (2) Is the cost of office space at relatively competitive levels? We have applied our own stress tests against these two benchmarks and we believe that the Singapore office market is in a reasonable state of health. Availability of office space: Office vacancy at present is fairly low (core CBD at 4.7 per cent and Grade A at 2.7 per cent), but far removed from the critical position of 2007 (core CBD at 2.7 per cent, and Grade A at 0.2 per cent). |

Looking ahead, there is a decent pipeline of new office space totalling 8.2 million sq ft of confirmed new supply over the next five years.

That said, about 54 per cent (4.4 million sq ft) of the total supply is slated for completion in 2011/12 of which 58 per cent is already pre-let.

Prominent sites

Come 2014/15 it is noteworthy that the delivery of new projects in prime core CBD tapers off. Whether the Khazanah-Temasek venture, M+S Pte Ltd, in Marina Bay fills this gap remains to be seen. That said, there will be a good array of strategically located alternatives available to occupiers. This includes the prominent site above Tanjong Pagar MRT station by GuocoLand and the one million sq ft North Buona Vista development by Ho Bee adjacent to the key MRT intersection of the East-West and Circle lines. The GLS programme could deliver further sites at Tanjong Pagar and Payer Lebar to supplement the above.

Note also that a fairly large volume of second-hand space will be released into the market as a result of relocations by a number of large occupiers. This space will supplement the decent array of choice available to tenants.

Assuming take-up at around 1.6 million sq ft through the next few years we are comfortable that the quantum of new office supply is balanced. In light of the proven appetite for the Marina Bay location (One Raffles Quay and Marina Bay Financial Centre are stand-out examples) it could be argued that there is a case for early release of further sites in the new downtown. The Urban Redevelopment Authority (URA) has indicated that it intends to bring further sites onto the market only after 2013.

Occupier demand

We are in a good place versus the Asian regional centres. It is true that Singapore is not a low office cost centre for business, but this is a function of the country's emergence as a true global city. The many advantages of the city are well reported and serve to mitigate higher rent costs. Going forward, we see a low probability for excessive rent escalations. Supply seems reasonable and we sense that occupier demand may moderate in the immediate term. We are projecting that full-year rent growth may ease back to around 12 per cent to 15 per cent. This is still decent by most markets' standards, but not likely to prove alarming to businesses.

Landlords and investors have every reason to be optimistic about longer term market performance in Singapore. In the meantime, occupiers that are attracted by the city's qualitative advantages may need to factor in higher operation cost assumptions, but can be assured that there is ready availability of high quality office space to grow.

The writer is executive director, Office Services, at CB Richard Ellis

CONSUMER PROTECTION LEGISLATION

Business Times - 08 Feb 2011

Rules to make showflats fall in line with the truth

Developers will have to make sure that the units give an accurate picture and don't mislead buyersBy UMA SHANKARI

(SINGAPORE) The Ministry of National Development (MND) plans to introduce new regulations to make sure that developers build showflats that accurately represent the actual units in a project, sources told BT.

The move is meant to ensure that buyers are not misled by the interior design work at some showflats, which developers use to entice buyers before a residential development is completed.

Developers have been known to leave out structural walls and columns when building showflats in order to make apartments seem more spacious. Another common tactic is to avoid clearly marking where a balcony starts, which makes living rooms appear larger.

With the new rules, developers will be prevented from leaving out structural walls and columns from their showflats if completed units in the development will have these structures.

In addition, structural walls in showflats will have to be of the same thickness as those in the actual homes. Non-structural walls will have to be clearly marked out. Showflat ceiling heights will have to be accurately reflected as well.

The transition from the living room to the balcony will also have to be clearly demarcated, although how this can be done is still being finalised.

MND could also mandate that other essential elements such as bomb shelters and service balconies have to be present in showflats, sources added.

The ministry is likely to launch a consultation exercise within the next few weeks before finalising the new regulations. The new rules could then be implemented in the second half of this year, BT understands.

Developers BT spoke to said that the problem of misleading showflats is not all that common in Singapore.

'The bigger boys don't really do it (build misleading showflats),' one developer said. 'But it happens, especially with so many new entrants in the market.'

Of late, a few developments - including those offering mostly small, 'shoebox' units - have come under criticism for having showflats with ceiling heights that are 'not real', extending living room spaces into balconies, and extensive use of glass and mirror walls in the place of structural walls.

In one extreme case, an entire wall which was supposed to separate one unit's living room from the next apartment was replaced by just masking tape on the floor - albeit high-end masking tape.

Sometimes, even sales agents who walk prospective buyers through such showflats do not know that they are not accurate representations of the completed units.

Analysts welcomed the planned regulations, which are seen to be in the interest of genuine owner-occupier homebuyers.

'This ought to have been done some time ago to weed out unscrupulous developers,' said Knight Frank chairman Tan Tiong Cheng.

'The whole idea of building a showflat is to illustrate the possibility of what can be done with the actual unit. If the interior design work is misleading - such as when structural walls and columns are left out - then the point is lost; you can't do that with your own unit,' Mr Tan said.

Added Ku Swee Yong, chief executive of International Property Advisor: 'A showflat should fully represent the location and thickness of the walls and pillars. Ceiling heights also have to be accurate. This will give a much closer representation of the space that an investor will enjoy when he receives the keys to his apartment.'

Mr Ku added that investors who are concerned that showflats may not fully represent the actual product should consider completed properties instead.

http://www.businesstimes.com.

GOOD CLASS BUNGALOW : SINGLE FAMILY RESIDENCES

Published March 9, 2011

| |

Cluny Road GCB fetches record $2,038 psf

Buyer is said to be the executive chairman of Midas Holdings

By KALPANA RASHIWALA

(SINGAPORE) A record land price per unit has been set for a Good Class Bungalow (GCB) transaction: a bungalow at Cluny Road has been sold for $33 million or about $2,038 per square foot (psf) on the freehold land area of about 16,200 sq ft. The seller is understood to be an investment banker, a British national who is a Singapore permanent resident. The buyer is said to be Singapore-listed Midas Holdings executive chairman Chen Wei Ping. The former China national is now a Singapore citizen. The $2,038 psf he is paying for the Cluny Road bungalow surpasses the previous high of $1,899 psf on land area that Raffles Education founder and chairman Chew Hua Seng paid in October 2007 for 32H Nassim Road. Incidentally, Mr Chew and Mr Chen are understood to be friends. The latest transaction at Cluny Road was handled by Renee Lim of Singapore Home Search, who co-brokered the deal with Samuel Eyo of Savills Singapore. An option for the sale of the same property had been granted last year apparently at the same price, but that deal later fell through as the potential buyer, a Singapore permanent resident, was not given approval by the Land Dealings (Approval) Unit of the Singapore Land Authority, BT understands. The bungalow is a two- storey property with a basement and understood to have been completed a couple of years ago. It was designed by Guz Architects. The house bagged an honourable mention under the residential category at the Singapore Institute of Architects' Architectural Design Awards 2010. The house uses photovoltaic cells and solar water heaters to save energy and recycles rainwater for the irrigation, as well as recycled teak with reconstituted timber in the design. The judges citation read: 'The jury were impressed with how the architect has integrated the landscape and the building so much so that the architecture and nature merged into a seamless and formless whole. Thick and lush greenery has made the building completely disappear and nature has taken over the view.' While a record unit land price has been set for a GCB transaction, sales activity for such bungalows, the most prestigious on mainland Singapore, has cooled in the first two months of this year after the record $2.27 billion deals involving 121 transactions achieved last year, according to CB Richard Ellis figures. Director (luxury homes) at CBRE, said that with the punitive seller's stamp duty rates announced under the Jan 13 property cooling measures for those who buy a private residential property after that date and sell it within four years, activity in the GCB market is expected to slow down in the short term as speculators bow out of the market, with owner-occupiers and long-term investors remaining the main players. 'The current stand-off between buyers and sellers as well as the Chinese New Year festivities have also contributed to the slow down in the first two months. Some offers have been made for GCBs but these have been below the sellers' expectations. 'A more visible trend should emerge in the next three to six months but overall, prices are expected to increase 3 to 5 per cent in 2011,' he added. Newsman Realty managing director KH Tan observed that after hibernating in the first two months of this year, potential buyers are on the prowl again. 'I think GCB prices will remain strong and a 10-15 per cent price increase this year is quite a high possibility. While those who trade in GCBs will be affected by the seller's stamp duty, demand from others who are buying for long-term investment or for their own occupation will remain strong. 'Lately we have seen interest from some Singaporeans doing business in Hong Kong/China; high net worth new Singapore citizens also remain keen on GCBs due to the limited stock of such properties in Singapore.' http://www.businesstimes.com.

PRC INVESTORS

Chinese now comprise largest buying group of Bungalows

Foreigners' share of bungalow deals hits 11.7% last year, from 9.1% in 2009 The Chinese picked up 15 bungalows in District 4 last year, nearly double the eight properties they acquired in the area in 2009 Mainland Chinese replaced Malaysians as the biggest foreign buyers (including permanent residents) of bungalows across Singapore last year, shows a caveats analysis by CB Richard Ellis. China nationals picked up 19 properties in 2010, giving them a 3.3 per cent share of the total 571 caveats lodged for bungalows last year. UK citizens were in second place, with 11 deals or 1.9 per cent share, followed by Malaysians, who picked up eight bungalows (1.4 per cent share). In 2009, Malaysians were the number one buyers, followed by UK citizens and mainland Chinese. Foreigners' (including PRs') share of bungalow purchases across Singapore rose from 9.1 per cent in 2009 to 11.7 per cent in 2010, surpassing their 11 per cent share in 2007. Companies' share of purchases rose from 10.8 per cent in 2009 to 12.3 per cent last year. Singaporeans remained the predominant buyers of bungalows, accounting for 434 deals (76 per cent of all bungalow purchases) last year. However, this is lower than their 80.1 per cent share in 2009. Throughout Singapore, a total 571 caveats were lodged for bungalow purchases last year, up 6.3 per cent from 2009 but still 29.7 per cent lower than the high of 812 deals in 2007. The Chinese were most active in District 4 (which includes Sentosa Cove) where they picked up 15 bungalows last year, nearly double the eight properties they acquired in the area in 2009. They were the biggest foreign buyers in the district for both years. Singaporeans, however, bought even more bungalows in the district - 15 in 2009 and 23 in 2010. After the Chinese, Indonesians were the next biggest foreign buyers of bungalows in District 4 with six deals, followed by Malaysians (three deals) last year. District 10 - a high-end bungalow location on mainland Singapore - last year saw three purchases each by Australians and Malaysians, and two purchases each by Chinese and UK citizens. -- 2011 SINGAPORE BUSINESS TIMES |

March 31, 2011, 6.54 pm (Singapore time)

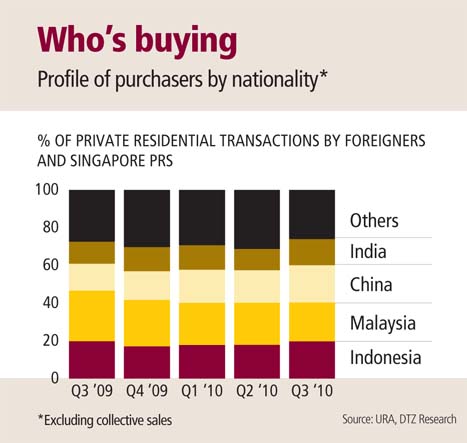

-- 2011 April 14 PROPERTY POST -- 2011 April 14 PROPERTY POSTOChinese - Overseas buyers in Singapore The Chinese have overtaken Malaysians as the second-largest overseas buyers in Singapore’s residential market, despite the Singaporean government introducing measures aimed at cooling down the market.PRC buyers a force in Singapore's residential market Home hunters from China are becoming a force to be reckoned with in Singapore, and their presence could grow further as the authorities on the mainland and in Hong Kong clamp down on real estate speculation. FOREIGN INVESTMENT IN SINGAPORE | |||

CapitaLand ropes in Mitsubishi Estate to develop condo in Bishan

By ANGELA TAN

CapitaLand Limited said on Thursday that it has entered into a joint venture with Japan's Mitsubishi Estate Asia Pte. Ltd (MEA) to jointly develop the residential condominium site at Bishan Street 14. CapitaLand will have an effective 75% interest in the joint venture company, Bishan Realty Pte. Ltd. (BRPL), whilst MEA will have the remaining 25% interest. CapitaLand will be the lead development manager for the site and is responsible for the full spectrum of sales and marketing, product design and development, and project management. The site was won by CapitaLand in a HDB tender for S$550.1 million on February 28, 2011. Located in central Singapore, the 11,997-square-metre (129,137 square feet) site has an estimated gross floor area of about 58,786 square metres (632,770 square feet). http://www.businesstimes.com. | |||

No comments:

Post a Comment